How to calculate monthly PCB income tax in malaysia

My monthly PCB income tax is increased much since march 2009, HR told me that Malaysia monthly income tax PCB deduction rate is changed since year 2009.

Income tax PCB calculation

Here’s the calculation.

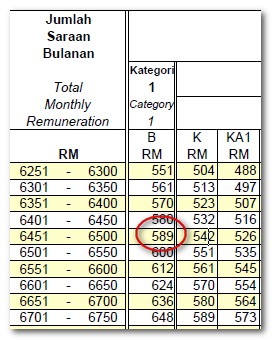

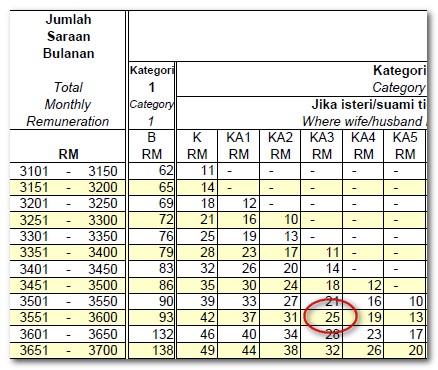

1. Find your PCB amount in this Income tax PCB 2009 Chart

2. Calculate your taxable salary – Taxable Salary = (Gross Salary – EPF)

- EPF is equals to your 11% gross salary.

- EPF deduction is restricted to RM500 only, any amount above RM500 is consider lost.

The PCB calculation is only take EPF as deduction. Please do not deduct your “SOCSO” and any other benefits.

Case Study 1

I’m single, no child, and my monthly salary is RM7000 (i hope so 🙂 )

1) My EPF is RM7000 x 0.11 = RM770 (take maximum RM500 for deduction).

2) My taxable salary is RM7000-RM500 = RM6500

3) Income tax PCB 2009 Chart show RM6500 taxable salary need to pay RM589

My monthly PCB income tax is RM589.

Case Study 2

Married, wife is not working , 3 children, and monthly salary is RM4000 (How can survive in Malaysia? )

1) EPF is RM4000 x 0.11 = RM440

2) Taxable salary is RM4000-RM440 = RM3560

3) Income tax PCB 2009 Chart show RM3560 taxable salary need to pay RM25

Monthly PCB income tax is RM25.

At last, I’m not a professional tax agent, i’m just a normal worker like you all. Please correct me if above PCB calculation is wrong. Thanks

Where to get latest Income tax PCB Chart?

i am working men and earn monthly salary RM6000 & how much i need to pay the salary tax?

HI, you can contact us via 012-603 6601..we do have provide payroll software to handle month end salary even in very difficult situation..do contact us for more detail.

Hi, may I know the minimum of monthly and yearly income we need to pay for tax?

May i ask the travelling allowance is it a taxable salary ?

Hi,

May I have the calculation for the monthly PCB deduction for below:

Basic Salary: RM 6,000.00

Overtime: RM 700.00

Transport Allowance: 500.00

Shift Allowance: RM 300.00

Commission: RM 1000.00

Fixed Allowance: RM 300.00

Back Pay Overtime: RM 875.00

Completion Bonus: RM 6000.00

Kindly show me the calculation. Thank you!!!

HI, you can contact us via 012-603 6601..we do have provide payroll software to handle month end salary even in very difficult situation..do contact us for more detail.

if salary after deduct EPF is RM11551.00, then the PCB is?

I’m a single person with basic income RM2200,total monthly income including OT average RM4000,my question is deduction of EPF is 11% of basic income,do i still need to pay PCB?cause company deduct PCB tax from my salary every month since 01 June 2013,i joint at 01june 2012,please reply,thanks!

Hi,I need some help..

As above you mention that (The PCB calculation is only take EPF as deduction. Please do not deduct your “SOCSO” and any other benefits.)

So the other benefits is it saying OT/Allowance??

And Salary + Bonus + EPF = PCB?

URGENT , thanks..

Director fee need to pay pcb or income tax?

I’m earning 24k/month, I’m supporting my 2 wives, 3 of my children and my family(sister brothers, pa, ma). how do i calculate my PCB? I’ve been ignorant about this thing for so long…..

Find a accountant.

Hahaha love your answer…

E-FILLING is the best solution when i do for my boss (2 wives 6 children and his parents).

Hi, I’m earning RM5.5k a month. I’m single. What is my real salary after deduction again?

If company director, no salary but pay director allowance/fee( if payment is not fix every month) is it laible for PCB DEDUCTION. If yes, how do calculate . TQVM

Hi,

Situation :

I’m a single & haven married ,

My monthly salary is RM 2500.00, after deducted EPF RM 257.00 is RM2243.00 for year 2011, is it need to summit tax also?

I never report tax before, please tell me how to calculate , please ~ thank you !!

Why salary RM 2500.00, my company did not deduct PCB on my salary?

Until this year(2012) my salary increase to RM 2700.00, my company still did not deduct PCB on my salary, is it i not entitle to pay PCB/Tax?

Thanks!

VNS

Would like to know your answer cause same situation? can sharing?

Thanks.

KKW

i don’t think so if ur salary is below than 3,500 u need to worry about it.

I reckon this PCB is applicable to all? I am from Brunei and earning RM 5,000 per month. A single package. How to calculate PCB? And do I pay EPF too?

Hi,

I’m working as a account assistant in my new company ,

just realize that , almost all the employee monthly salary is over RM3000.00

Is it i need to prepared the PCB for them ?

1] Monthly salary over how much i need do the PCB ?

2] Situation :

I’m a single n no child + haven married ,

My monthly salary is RM 2200.00

My monthly commission RM 1500.00 (not fixed )

Please tell me how to calculate , please ~ thank you !!

I’m working with a monthly salary of RM 4000.Every month I’m deducted RM32 for my PCB.

Recently I received my bonus RM 5000 and after deduction of my EPF RM 550 I’m deducted RM 1135. Is the calculation correct or am i over deduct.I have three kids and my wife is a housewife till mid of Jun. She start working only in JUN 2011.Is the maximum deduction for EPF is RM500.Is it true.

ALL Pro tax Master,

i have no report since start work till now , ( for 2000) now i wan to clar or say report tax , how can i do ? what the step i should take ?

i know this is quite old, but have u start paying? my case is slightly different after i chnge work back in 2008 that comp didnt pay (foreign n dont even bother abt msia rule). until may 2010 (so no report for that 2 years). then my new comp they start paying tax. when efiling come lhdn actually send a notification to my comp to deduct more, but not that much.

Hi,

As per the Malaysian tax rule i am suppose to stay 182 days for the calendar year. but in 2010 i was der in Malaysia for 173 Days.Now also i am in Malaysia.That means from 11 july 2010 to march 2011 i have not left the country .will they link 2010 and 2011 to make a total of 182 days.

I am eligible to be away from the country for 14 days.so will they reduce this 14 days from 182 days?? So that i can make to be a resident .

Regards,

Vinod

[email protected]

sorry but i have to ask a really dumb question. tax deduction is done monthly thru PCB. why do we still need to do submission via e-filing. all this while i never gave a damn and have been flat-out ignorant abt this. I know i had to ask someone.

for those salary very high, suggest change your employments to contract base,

then you could knock off your income with your daily expenses like Oil, parking, daily meal (with receipt).

i am doctor in gov hosp. only have basic salary about 3k . total about 4k if plus all the allowance. how to survive in KL, malaysia with family? advice dun waste time study doc or serve gov.

after you get the experience, go to private hospital, should be lucrative gua…. better dont study accounting & marketing, the lowest pay in all industries… unless open audit/account/tax firm

can you pay my tax for me??

i am working women and earn monthly salary RM5000 & my husband earn monthly salary RM8000 and supporting 2 children. how much we need to pay the salary tax? If follow the salary tax schedule, my husband under the KA2 column, how about me? Am i calculated under KA2 or K?

u will be taken under K

both of u must vote which one of u take the children relief: below 18=RM1000/yer

your Year assessment will be like this:

Sec4(a)business income,

sec4(b)employment income,

sec4(c)dividend income,

sec4(d)rental income.

deduct

the relief:

personal: 9000/yer

child:

epf&insurance:6000max/yer

others…

then get the chargeable income.

your PCB base on K column.

I’m a married man with 3 sons below 10 years old, my wife is not working. My basic salary is @ RM 5300.00 per month, allowance is RM 2500.00 per month. How to count my PCB?

How can you pay the tax?

– It is deducted automatically every month by your employer so no worries

How do you declare your tax?

– You do that betwwen March to end of April every year via the tax declaration form appropriate for you (e.g. BE form for blue collars).

I’m single with monthly salary RM3000. I’m supporting my mom, sisters and insurance for her too. Basically, i take care of house/everything. I cant safe a cent from my income, how can i pay the tax? How does i declare my tax?

Gov give relief. You may refer to lhdn website. Normally your company will deduct pcb from your pay every month from Jan-dec. So next year by 30 apr, you must submit personal tax, better through e-filing (fast & easy).

Many ppl confuse…they thought no need to declare income tax for personal bcos company already deduct from their salary. But that is not the case, you still have to declare.

Let say in 2015, your total PCB deducted is RM1200 (assume RM100/month). You have to fill in the tax return form.

You need your EA form to do this. You can get all the figures from there. After deduct out all the relief (Eg. personal RM9000, EPF & life insurance RM6000 etc…), your actual tax might be lesser than what you have paid (RM1200). In this case, you get tax refund from LHDN. If your tax payable is more that RM1200, say RM1250, you need to pay the RM50. Can make online payment or pay at CIMB/PBB.

For your case, LHDN only let you deduct whatever is allowable (Books, medical exp, personal relief etc)… other than this is not deductible though every month you might left with zero or a few ringgit on hand.

Hope this clarifies.